TORONTO — The urgent need for a clear roadmap for Canada’s recovery coming out of the pandemic, especially where travel is concerned, was underlined by a panel of travel industry executives including Air Canada’s President and CEO Michael Rousseau and WestJet’s VP Government Relations & Regulatory Affairs Andy Gibbons at a webinar yesterday presented by the Canadian Airports Council (CAC).

Rousseau and Gibbons were joined on the panel by airport executives Tamara Vrooman (YVR) and Philippe Rainville (YUL), plus David Goldstein (Travel Alberta) and Patrick Doyle (American Express GBT). The panel was hosted by Perrin Beatty with the Canadian Chamber of Commerce and was part of the CAC’s 90-minute webinar on Air Travel Recovery in Canada.

While several provincial governments including Ontario, Quebec, B.C. and Alberta have come out with with step-by-step reopening plans, the federal government has not, said Beatty. “The Canadian Chamber of Commerce has been urging the government for a clear path for reopening,” he said. “But we’re still lacking a clear and predictable plan for the country.”

And as YVR’s Vrooman pointed out, a plan for reopening Canada’s borders isn’t just about the travel industry, it’s about Canada’s economic recovery overall. “I can’t speak strongly enough that this isn’t just related to our industry,” said Vrooman.

As the travel industry well knows, other countries and regions, including the U.S. and the EU, are reopening and, in the case of the EU and other countries, readying digital systems to confirm proof of vaccination, immunity through previous transmission of COVID-19, or negative tests.

Canada is working with its G7 counterparts to align Canada’s documentation with whatever systems are in place, as confirmed in recent months by Transport Minister Omar Alghabra and Health Minister Patty Hajdu.

Air Canada’s Rousseau stressed how important that alignment is for Canada’s recovery. “We have to get a solution on vaccine passports that’s coordinated with the G7 countries,” he said.

WestJet’s Gibbons summed it up: “All we really want is travel guidance based on the latest science. That’s what we want and that’s what we need.” Other countries have done that as a matter of course, said Gibbons, but “Canada has not.”

And as YVR’s Vrooman puts it, “We’re a business based on runways. What we need is a runway and a clear line of sight.”

After close to 15 months of an almost complete travel shutdown, it’s not just the airlines and airports calling for a reopening plan. “For the thousandth millionth time, give us a plan,” said Brett Walker, GM, Collette (Canada) earlier this month, echoing the frustrations of many retail travel agents, tour operators and other suppliers.

Yesterday’s webinar coincided with the CAC’s release of a whitepaper on aviation recovery, ‘Holding Pattern: Canada needs a Swift Recovery and Competitive Air Sector.’

Here are some of the points from the CAC-commission whitepaper, presented during the webinar by Solomon Wong, CEO, InterVistas:

- The number of passengers that moved through Canada’s airports in April 2021 was 9% of 2019’s levels.

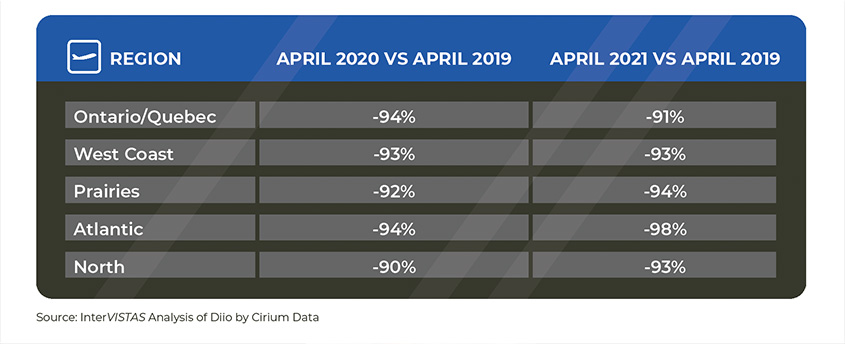

- Direct connectivity fell more than 90% across all Canadian regions in April 2020 versus April 2019. The picture for 2021 is just as dire, says the CAC, with direct connectivity falling even further compared to 2019.

- According to the CAC’s analysis, if increased costs for the aviation supply were to lead to a 25% increase in airfares, that would suppress 20% of passenger traffic (demand). Based on passenger traffic at Canadian airports in 2019, the expected loss in passenger demand would equate to roughly 16 million passengers – roughly three airports the size of Ottawa.

- In 2019, the average airfare paid by passengers in Canada was approximately $470, and there were approximately 162 million passengers at Canada’s airports. In the case of a hypothetical 25% and 50% increase in the price of air travel in Canada, the resulting average airfare would be approximately $590 and $705.

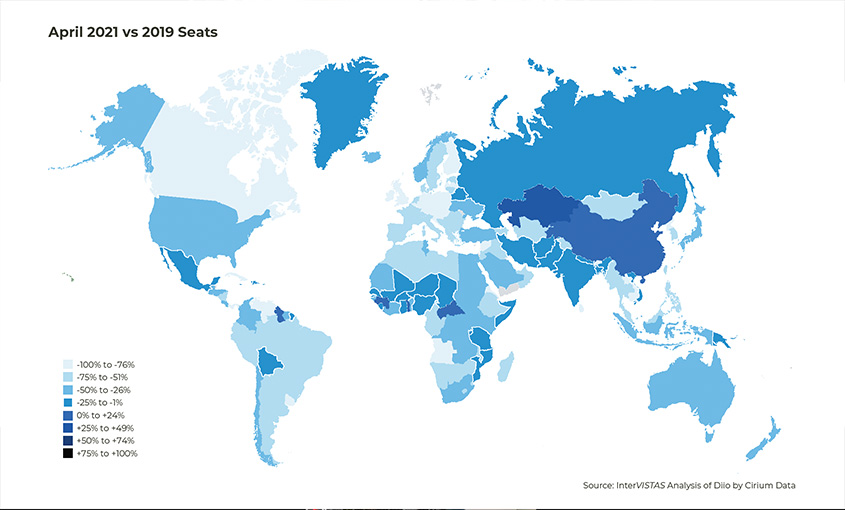

- The longer the recovery, the more difficult it will be for Canada’s airlines to compete in the same international aviation markets also served by foreign carriers, who may have a financial advantage over Canadian airlines due to government support these airlines may have received throughout the pandemic.

- The loss in passenger traffic has resulted in sharp reductions in overall airline capacity – measured by the number of seats available – at Canadian airports, some of which have lost all commercial air services during the pandemic (e.g., Toronto Billy Bishop Airport, Saint John Airport, Sydney Airport (Nova Scotia), and Prince Rupert Airport, among others). Medium-size airports such as Winnipeg and Regina have also been impacted, losing almost 80% of airline capacity and all direct international services.

- In terms of airline seat capacity, Canada has fallen from 16th to 23rd in the world, with capacity down roughly 80%.

- Direct connectivity fell more than 90% across all Canadian regions in April 2020 versus April 2019.

- The whitepaper also suggests that Canada’s aviation sector would benefit from deploying a recovery agenda that is at least in part compatible with that already initiated by the U.S., Canada’s largest trading partner.