TORONTO — Consultations on TICO’s five new proposals for its future funding framework, fee structure and Comp Fund are underway – and now it’s up to retail and wholesale registrants to learn more about the proposed changes, and have their say.

“We tried to make sure there’s something in [the proposals] for everyone – consumers, registrants and TICO,” said TICO President and CEO Richard Smart at yesterday’s trade media briefing. “We’ll course-correct if need be. But you have to start somewhere. The government is listening, and they understand the urgency.”

This isn’t the last time TICO will do a review, he added. In Phase II, in the next two to three years, TICO is aiming to move towards a risk-based model for the Comp Fund.

In the meantime, to address TICO’s long-standing funding gap and other inequities, and to ease the burden on smaller registrants, “larger registrants will pay more,” said Smart.

TICO’s President and CEO Richard Smart, CFO and Administrative Officer Sanja Skrbic, and Stakeholder Relations Manager, Kristina Wilson

Read on for more from the briefing.

THE 5 PROPOSALS

As reported yesterday, TICO’s proposed changes include first, decreasing Comp Fund payments to $0.05/$1,000 from $0.25/$1,000 of Ontario gross sales. The anticipated date for this change is April 1, 2024.

Second, TICO wants to remove non-contributing end-supplier coverage – that is, in cases of airline or cruise line failure – from the Comp Fund.

While getting end-supplier coverage out of the legislation means less robust consumer protection, Ontario travel agencies and wholesalers paying into the Comp Fund have been asking for a solution to the non-contributing end-supplier situation for decades. End-supplier failures have accounted for 14% of hits to the Fund since inception in 1977.

Third, TICO wants to double the maximum Comp Fund payment per person to $10,000, from $5,000, for consumers.

This raised cap on claims – after more than a decade at the current $5,000 level – also aligns with calls from the industry.

Both the raised claim cap proposal, and the end-supplier proposal, are subject to government consideration and decision-making, and are not within TICO’s authority to implement.

At yesterday’s briefing, Travelweek asked about the chances of these two proposals getting the government’s stamp of approval.

Smart said that he couldn’t speak for the government, “but if they were adverse to any of these [proposals], they wouldn’t be in there.”

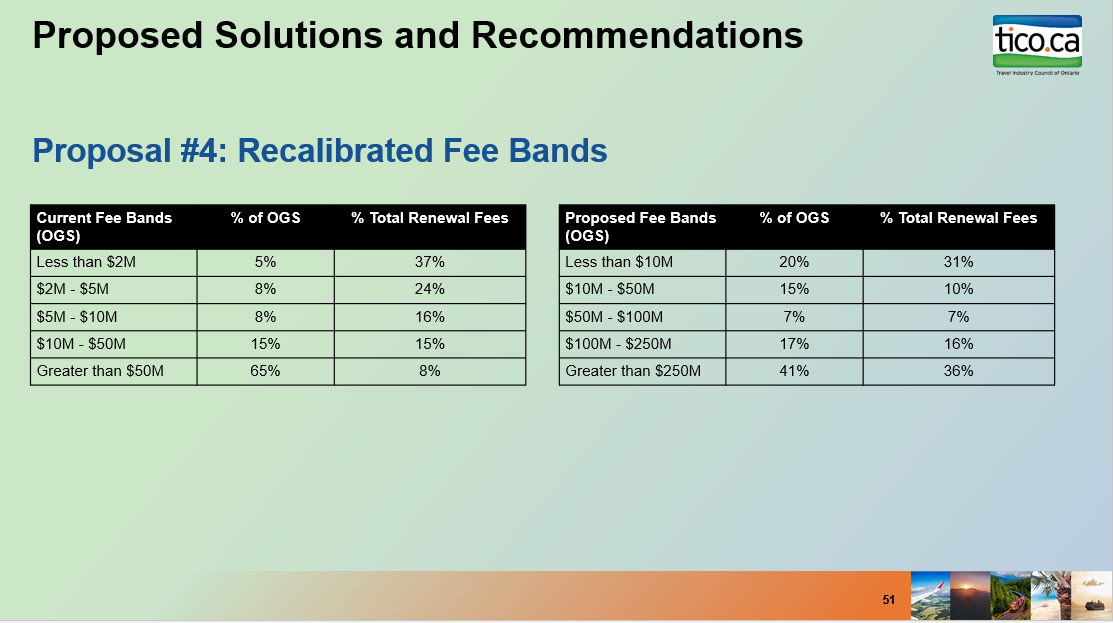

Fourth, TICO is proposing to recalibrate registrant renewal fees, with modernized and more equitable fee bands.

Put simply, larger registrants will pay more. “Companies with more gross sales will pay more,” said Smart. “We’re trying to reduce the burden on smaller registrants.”

The updated fee bands will also address TICO’s long-standing funding gap – another thorn in the side of industry, as since inception in 1977 TICO has had to use Comp Fund monies to help shoulder some of its operating costs. It’s all been above-board, but the funding gap was one of four key reasons TICO launched the review. Smart noted that TICO’s operating costs have remained constant over the past 10 years.

The chart on the left shows the current fee bands, where the biggest players in Ontario’s travel industry – those with Ontario gross sales (OGS) of more than $50 million – represent 65% of OGS, and pay 8% of total renewal fees to TICO, while the smallest players, with less than $2 million in OGS, represent 5% of the pie, but pay 37%. One of TICO’s new proposals aims to level the playing field with more equitable fee bands. The chart on the right shows the updated fee bands, anticipated to take effect April 1, 2024.

The anticipated implementation date for the updated fee bands is also April 1, 2024. Some 90% of registrants, i.e. those with Ontario gross sales under $10 million, will pay a flat renewal fee of $750.

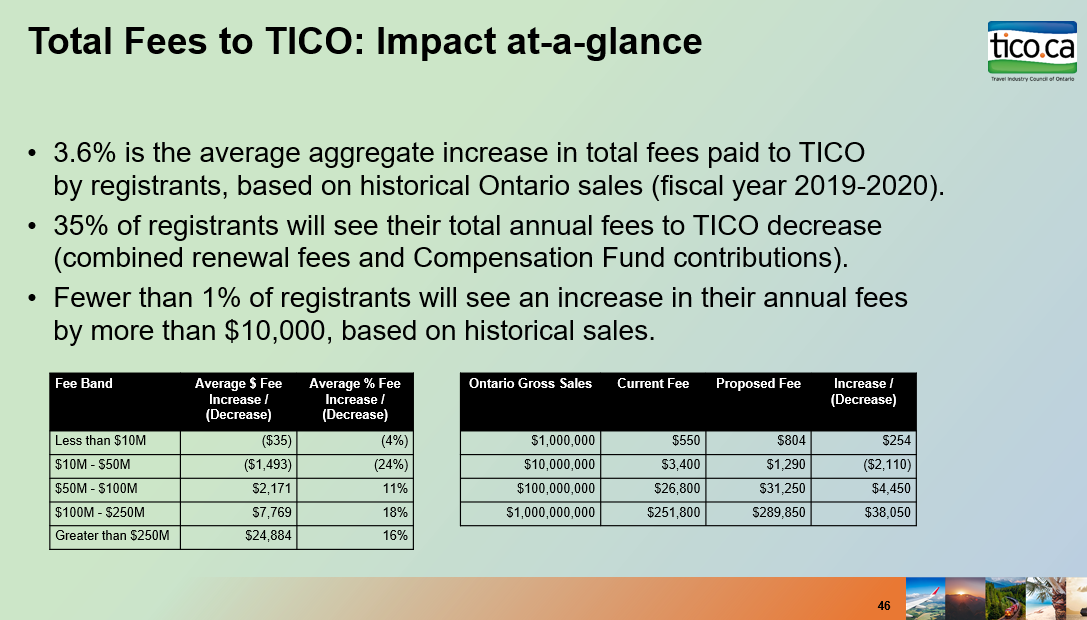

The number of registrants is just under 2,000, says Smart. Between combined registration renewal fees and Comp Fund payments, 35% of registrants will see their total fees to TICO decrease, and 65% will see an increase.

“Renewal fees have only changed twice in the last 26 years, and the last increase was in 2011,” said Smart. “We haven’t been aggressive with fees. And we’ve continued to absorb higher costs.”

Smart also noted that TICO also waived fees for three years during the pandemic. Pre-pandemic, Ontario gross sales for TICO registrants peaked at $18 billion, in 2018-2019. The industry’s average rate of growth over 10 years was 3.7%. Smart noted that TICO’s expenses have risen 2.8% over 10 years, from 2014 – 2023.

The fifth proposal – institute new late filing fees to encourage timely submission of required documentation and ensure efficient processing – is also anticipated to take effect April 1, 2024.

The outline of all five proposals, plus links to consultation info and more, is on TICO’s site.

MORE ON THE POINT-OF-SALE OPTION, AND CONSUMER-PAY MODELS

ACTA and CATO, as well as retail groups and individual travel advisors have been vocal for years about the need for updates to the Comp Fund model, and many have advocated for a consumer-pay model similar to that in Quebec.

As reported yesterday, and confirmed by Smart during the briefing, there is no legislated consumer-pay model in the new proposals.

However with the consultations TICO is encouraging the industry to weigh in on the possibility of a point-of-sale solution. Travel retailers and wholesalers could voluntarily pass on or display Comp Fund fees or registration renewal fees at the point of sale. As Smart notes, other Ontario regulators, including OMVIC (the Ontario Motor Vehicle Industry Council), have implemented voluntary approaches where the industry has the option to pass on certain regulatory fees to consumers.

During the year-long funding review, the consultancies spoke to members of ACTA and CATO, along with many other registrants, to gather insights. “That helped form the recommendations” for the proposals, said Smart, adding that the TICO board was also actively involved.

TICO has long maintained that any proposed changes to the funding model and Comp Fund must be reviewed by the government, as part of TICO’s mandate, before they’re made public.

Asked about the calls from ACTA and CATO for a consumer-pay model, Smart said: “I respect their views. We had more meetings with ACTA and CATO this week. In regards to Quebec’s consumer-pay model, I’ve always said that you can’t cherry-pick what you like and ignore what you don’t like [from other funding models]. Quebec has significantly more regulatory burden with their model. There would be a significant financial cost if we were going to replicate that. We’ve told ACTA and CATO, if you want a consumer-pay model, develop a proposal and take it to the government. When people say ‘let’s do the Quebec consumer-pay model’, those are policies, those are decisions that the Ontario government makes.”

He added: “The legislation’s not ours. It’s the government’s. We’ve been delegated to manage it accordingly. We’re here to protect consumers, and the cornerstone of that is the Compensation Fund. But not at all costs.”

Smart noted that TICO “is not a travel agency, and it’s not a tour operator. We’re a regulator. We’re self-managed but not self-regulated. We’re a creature of government.”

CONSULTATION PERIOD STARTS NOW

TICO’s consultations will remain open until Nov. 10, 2023, and there are plenty of ways to take part.

TICO’s new online survey allows registrants to provide feedback online. The survey takes 10 – 15 minutes to complete and is available until Nov. 10. Click here to take the survey.

There’s also the option to attend a virtual or in-person focus group …

. Thurs. Oct. 12 – Mississauga (three time slot options, all in-person sessions)

. Mon. Oct. 16 – virtual via Zoom

. Tues. Oct. 24 – Ottawa (three time slot options, all in-person sessions)

. Fri. Oct. 27 – virtual via Zoom

. Mon. Oct. 30 – virtual via Zoom for Northern Ontario registrants

. Thurs. Nov. 2 – Waterloo (three time slot options, all in-person sessions)

. Thurs. Nov. 7 – virtual via Zoom

To register for any of the above sessions, click here.

After Nov. 10, after the month-long consultation period wraps up, Smart says TICO will take all the feedback and put it into a report which will then be presented first to the TICO board, and then the Ontario government.

“Our mandate from Day 1 was to address the issues with the funding model,” said Smart. “We need to rectify the inequities.”

TICO also has a tool for registrants to estimate their fees payable to TICO (combined registration renewal fees and Comp Fund payments) under the proposed funding framework; click here for that tool.

These charts show the average fees, with brackets indicating a decrease, based on Ontario gross sales, for TICO registrants under the proposed new fee bands taking effect April 1, 2024. Since these are averages, TICO encourages registrants to check out its fee calculator at TICO.ca to estimate individual impact.