EDMONTON — It was “a fantastic day for Team Flair,” said CEO Stephen Jones yesterday, after the Canadian Transportation Agency handed down its determination that Flair Airlines is, in fact, a Canadian company.

Flair’s fate had been hanging in the balance for months, ever since March 2022 when the CTA issued its preliminary determination questioning whether or not Flair meets Canada’s requirements for Canadian ownership.

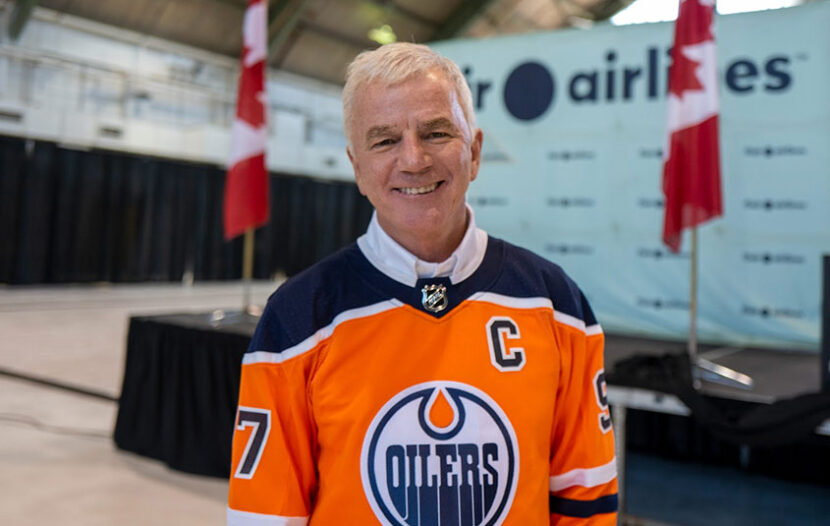

Flair scheduled a press conference for June 1, knowing that the CTA’s determination would be handed down that day. Now “the question has been answered. It’s done,” said Jones at yesterday’s press conference at Edmonton Airport. “Flair is Canadian. We’re thrilled to receive the positive determination from the CTA.”

Going forward Jones said Flair will continue to focus on offering affordable air travel to Canadians. A 48-hour sale started yesterday, offering 50% off base fares for travel through June 23, to any of Flair’s 40+ destinations in Canada and the U.S.

“SIGNIFICANT CONCESSIONS”

The CTA’s concerns surrounding Flair’s ownership stemmed from federal regulations that foreign ownership in Canadian airlines can’t be higher than 49%. That percentage drops to 25% if the foreign investment is from one individual. There are also rules around foreign interests controlling a Canadian carrier.

777 Partners, based in Miami, owns 25% of Flair, and leases a number of aircraft to the airline. 777 Partners is also a lender, and helped Flair weather the pandemic.

At an April 2022 press conference aimed at setting the record straight, Jones said: “Flair wasn’t part of the billions in bailout funding [from the Canadian government]. Instead we turned to our shareholders to survive, and 777 Partners provided a lifeline to protect thousands of jobs from coast to coast. 777 Partners “has never used the fact that they were providing cash to exert day-to-day control.”

Yesterday Jones said Flair has made “significant concessions” in response to the CTA’s concerns. “We’ve changed things to make sure the position is without a doubt. We are a Canadian airline.”

Asked what Flair could have done differently to have avoided the caution flag from the CTA, Jones said Flair’s 2018 governance document “could have been more clear.”

Later he added: “There’s been ambiguity. We’re taken it away. We’ve always been a Canadian airline. It’s just much more clear now.”

“WE’RE HERE TO COMPETE, WE’RE HERE TO WIN”

Over the years Canadian travel agents have seen quite a few ultra-low cost and low cost carriers come and go – from Greyhound Air to Roots Air to Jetsgo to Zoom Airlines, just to name a few.

Plus, ULCCs and LCCs aren’t always known for working with travel agents, and with their streamlined cost model, very few offer commission. For both of those reasons, budget airlines don’t get a lot of notice from the travel trade.

But the CTA’s scrutiny of Flair caught the industry’s attention, especially as it came just as travel was finally starting to rebound after two long pandemic years.

In April 2022, in reaction to Flair’s 18-month exemption request to the CTA, several of Canada’s biggest airlines including Air Canada, WestJet and Air Transat weighed in via a statement from the National Airports Council of Canada (NACC): “Domestic control and ownership is not just a ‘nice to have’, it is a necessary underpinning of the system, and should be defended.”

Jones doesn’t mince words when it comes to the NACC. Yesterday he called it “a puppet organization of the big air carriers.” He later added: “We’ll focus on our job, and the others will do what they do. We love competing, we’re here to compete, we’re here to win.”

Flair currently has 14 aircraft, and that number will rise to 19 by July 2022. Another eight to 10 aircraft are on the way by summer 2023.

Flair is just one of many Canadian airlines battling it out for more market share in the months ahead. New-on-the-scene ULCC Lynx Air launched in April 2022. Start-up Canada Jetlines, while not a low-cost carrier, is also determined to win over passengers and just received its Stage 2 approval from the CTA. The long list of course also includes Air Canada and Air Canada Rouge, WestJet and Swoop, Transat, Sunwing, Porter Airlines (with expansion plans of its own) and more.