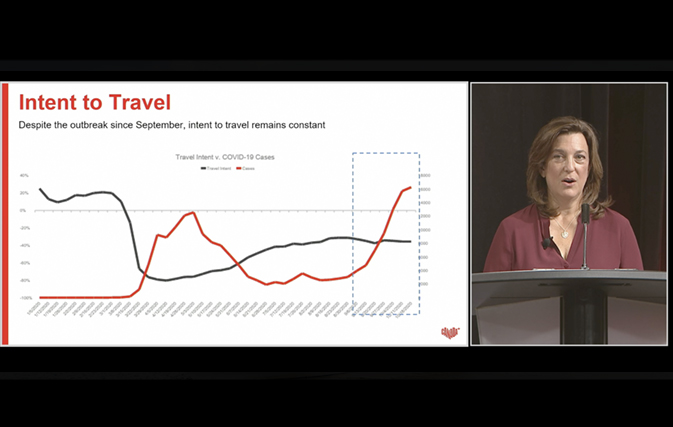

TORONTO — Looking at the ‘Intent to Travel’ stats coming out of Destination Canada’s AGM yesterday, Gloria Loree, Destination Canada’s Chief Marketing Officer, noted that while travel intent for trips within Canada dropped sharply in the first few months of the pandemic, it came back somewhat in the summer months.

And more importantly, despite the second wave that we’re in right now, the recovery in travel intent levels from the summer hasn’t wavered too much for the fall and winter months. “The intent to travel is remaining steady,” said Loree.

In her ‘Intent to Travel’ graph, the black line representing intent does a dramatic drop in mid-to-late March, but by May it was climbing back up. And even as case numbers shot back up in September onwards, the black line didn’t drop again.

It was a bright spot in a series of virtual presentations that didn’t mince words about the current situation for tourism into and within Canada amid the pandemic, after more than eight months of travel restrictions and a closed border.

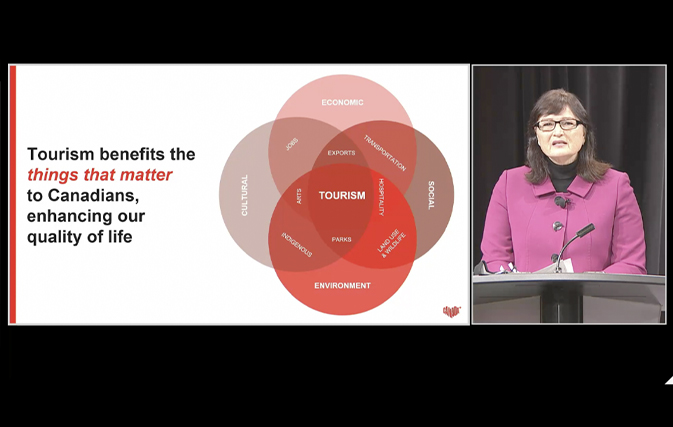

Introducing the AGM, officially Destination Canada’s Virtual Annual Public Meeting 2020, the association’s President, Marsha Walden, said, “I won’t sugarcoat it. Things are dire. And they are deteriorating.”

Marsha Walden, President, Destination Canada

While Destination Canada focuses primarily on inbound travel to Canada from international markets – typically not of interest to Canadian travel agents selling outbound travel – the association did ramp up its outreach to the travel trade here at home as more travellers came to their travel agents with questions about domestic trips this summer.

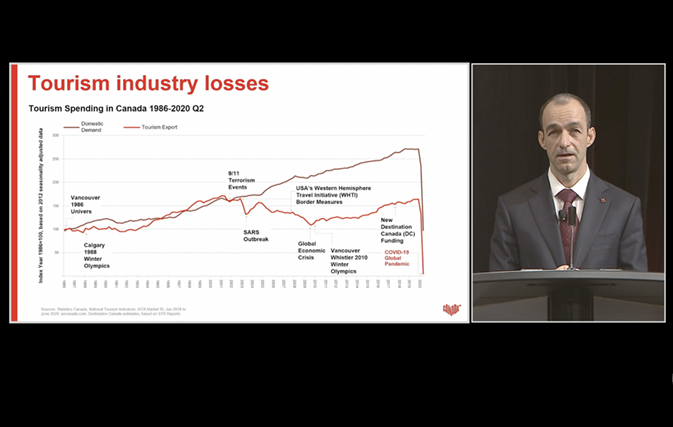

Chantz Strong, Destination Canada’s Executive Director, led an overview of industry impact stats that came as no surprise given the COVID-19 crisis, but was sobering nonetheless.

Chantz Strong, Executive Director, Destination Canada

Tourism industry losses included 95% of revenues lost by Canada’s domestic airlines in Q2, and 90% lost in Q3. Meanwhile Canada’s accommodation sector lost 75% of revenues in Q2 and 64% in Q3.

“The impact is unprecedented,” said Strong, adding, “I know that word gets used a lot. But in the case of tourism in Canada, it is unprecedented.”

Walden said it may take until 2025 for the Canadian tourism industry to get back to 2019 levels. “We know that many tourism businesses will not be able to hang on,” she said.

Strong’s numbers included 1.9 million total jobs in Canada’s tourism industry, and 748,000 direct jobs. One in 10 jobs in Canada is tourism-dependent, says Strong. “We could lose more than half the jobs in the visitor economy in 2020,” said Strong. Business closures in the accommodation and food sectors hit 24.3% in the first six months of 2020.

And the leanest months are still to come, he added, from November to March, traditionally low season for Canadian tourism.

Marsha Walden, President, Destination Canada