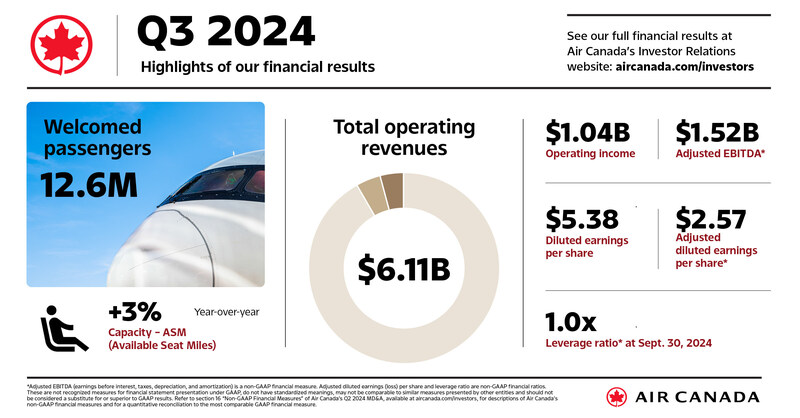

MONTREAL — Air Canada reported a third-quarter profit of $2.04 billion, up from $1.25 billion in the same quarter last year, as its operating revenue edged slower.

Operating revenue for the quarter totalled $6.11 billion, down from $6.34 billion in the same quarter last year.

In its outlook, the airline says it now expects its capacity measured by available seat miles for 2024 to be up about 5% from 2023 compared with earlier expectations for growth of 5.5 to 6.5%.

It also says it now expects its adjusted cost per available seat mile to be up about 2% from 2023, compared with earlier expectations for growth of 2.5 to 3.5%. Air Canada’s adjusted earnings before interest, taxes, depreciation and amortization for 2024 is expected to total about $3.5 billion, up from earlier guidance for between $3.1 billion and $3.4 billion.

“Air Canada reported solid results for the third quarter on key metrics, with operating revenues of $6.1 billion and operating income of $1 billion. Adjusted EBITDA of $1.5 billion and our adjusted earnings per share of $2.57 were both ahead of market expectations. We delivered on our ongoing operational improvement program, with quarterly on-time performance rising eight percentage points over the same period in 2023. I thank all our employees for their care and dedication in safely moving nearly 13 million customers in the quarter, including our Olympic and Paralympic athletes to the summer games in Paris,” said Air Canada’s President and Chief Executive, Michael Rousseau.

“Summer is our peak season and this year our pilot contract negotiations added complexity. We proactively offered options and flexibility to customers, and I am proud that we concluded a mutually beneficial agreement without significant disruption to customers and with a contained revenue impact. I thank our customers for their loyalty and reiterate our promise to keep providing industry-leading products and services to them,” he added.

Rousseau said the demand environment remains favourable. “We have adjusted our full year guidance and underlying assumptions to account for the evolution of the fuel price environment and for certain contract-related adjustments. We are delivering on our commitments and are confident in our future,” he said.

With file from The Canadian Press

Air Canada Reports Third Quarter 2024 Financial Results. (CNW Group/Air Canada)